WIZS Radio Henderson Local News 06-02-25 Noon

Listen On Air at 8am, 12pm, 5pm M-F

WIZS Radio ~ 100.1FM/1450AM

Click Play!

Listen On Air at 8am, 12pm, 5pm M-F

WIZS Radio ~ 100.1FM/1450AM

Click Play!

On the Vance County Cooperative Extension Report from Wayne Rowland:

Blossom-end rot can be prevented by the correct amount of calcium in the soil and correct watering of tomatoes.

Listen live at 100.1 FM / 1450 AM / or on the live stream at WIZS.com at 11:50 a.m. Mon, Tues & Thurs.

Click Play!

STEM Early High School is the site for a free food distribution event on Tuesday, June 3, sponsored by the Food Bank of Central & Eastern North Carolina.

The school is located at the Vance County Schools’ Center for Innovation, 219 Charles St. in Henderson. The event will be held from 4:30 p.m. to 6:30 p.m.

Shelf-stable items, as well as fresh produce, will be available to all, and no registration is needed.

Come learn how to receive Grab-N-Go meal boxes for the summer!

Questions? Email to kidsprograms@foodbankcenc.org.

This year’s Blessed Trinity Ministries Revival begins Monday, June 2 and runs through Friday, June 6. The revival begins at 7 p.m. each evening at Back to Eden, located at 105 Spellman Loop off Satterwhite Point Road, and organizer and pastor Rev. Dr. Almice Floyd Gill invites the entire community to come out and be refreshed by hearing the word of God from five different preachers from the area.

“I’m not preaching this year, but I’ll be talking every night,” Floyd Gill said on Thursday’s TownTalk. Her role is more of facilitator for the weeklong revival, which will offer a whole new list of ministers, reverends and pastors who are taking part.

She said this year’s participants will offer a variety of messages for revival participants, and she said to expect the speakers to present their messages with “power, conviction and in love.”

“The revivalists from last year were great,” she said, and added that this year’s speakers will hopefully expand and invite even more people to attend the nightly services.

As in the Book of Nehemiah in the Bible, Floyd Gill said she prayed to God to ask for guidance as she began to plan the 2025 revival – God blesses those who work faithfully, and she wanted to emulate Nehemiah’s actions to help accomplish her goal to get the Word of God out to people in the community.

“We don’t want the revival to be routine,” she said, and invites any and all to attend the five-night event.

Here’s the lineup:

If you can’t make it in person, find Blessed Trinity Ministries on Facebook to view live or join via conference call to listen to the revival each evening. Simply call 605.475.4700 and use Passcode 751573 to connect.

Anyone wishing to make a donation is welcome to do so, she said, adding that there are numerous ways to give: bring cash, check, cashier’s check or money order to the revival or mail to: Blessed Trinity Ministries, P.O. Box 3241, Henderson, NC 27536

Pay online as well using Gill’s number 252.438.0397. Donations may be made via apps like Zelle and Apple Pay

or via Cash App to $meeciefg.

She said all donations go to the church treasury to support its mission. “We’re thankful for every penny that anybody gives.”

CLICK PLAY!

Visitors to the Vance County Regional Farmers Market have no doubt noticed the lovely garden space that greets them as they make their way up the driveway to the parking area.

It’s a beautiful space, to be sure. But if you’ve never taken a few minutes to stop and look closely at the native plant specimens that are contained in that small one-tenth of an acre, you’re really missing out.

Cooperative Extension Agent Michael Ellington explained that the garden, designed, created and maintained by Master Gardeners, is at once a natural habitat, a classroom and a sanctuary.

There are benches nestled among the greenery for people to stop and enjoy the peace within the garden.

Each different plant has its own marker that identifies it by name, and a QR code that visitors can use to learn more.

All the plants were carefully chosen to support pollinators like bees, butterflies and more.

“It’s literally buzzing with life,” Ellington said of the garden, which is chock full of pollinator-friendly perennials, herbs, flowering shrubs and more.

Volunteers from the Master Gardeners group are on hand each second and fourth Saturday from 8 a.m. to 1 p.m. when the market is open to share information about the garden and practices that homeowners and aspiring gardeners can use in their own spaces.

They’re working to create a seed library, too, so if there’s a plant you like in the memorial garden and can’t find it in a retail store, just wait.

You may just be able to get some seeds from the library to take home to your own garden.

Snap a pic of the tag and be able to take a plant home soon.

Learn more about Cooperative Extension programs and activities at

https://vance.ces.ncsu.edu/ and click on https://vance.ces.ncsu.edu/vance-county-regional-farmers-market/ to learn more about the Vance County Regional Farmers Market.

Listen On Air at 8am, 12pm, 5pm M-F

WIZS Radio ~ 100.1FM/1450AM

Click Play!

Vance County Cooperative Extension Report from Jamon Glover

Listen live at 100.1 FM / 1450 AM / or on the live stream at WIZS.com at 11:50 a.m. Mon, Tues & Thurs.

Click Play!

The Edmonds Tennis & Education Foundation is hosting a “Tennis and Dentist” event on Saturday, May 31 to combine learning about the sport of tennis and the importance of good oral hygiene.

Things will get underway at 10 a.m. at Fox Pond Park, 375 Vicksboro Rd. and will continue until 2 p.m., according to Dr. Jerry Edmonds, who founded the organization with his wife Dorcel in 2018.

In case of rain, the event will move to Aycock Rec Center, Edmonds said.

The tennis clinic is free and is open to youth between the ages of 5 and 18.

Participants will learn tennis fundamentals, learn about dental health and get lunch, too.

Racquets and tennis balls will be provided.

Tennis is a relatively inexpensive sport, and there are public courts all around just waiting to be used. All tennis players need is a racquet, a can of balls and a good pair of tennis shoes and they’ll be all set.

The Edmonds Tennis & Education Foundation is a nonprofit that combines tennis, academics and nutrition to strengthen young people for success.

Visit https://www.edmondstennis.org/ to learn more about the organization.

Click Play!

The community garden at the Vance County Regional Farmers Market held its official grand opening Saturday, May 24, 2025.

Dr. Wykia Macon, director of the Vance County Cooperative Extension, was on hand and hands on!

She spoke recently at the Vance County Regional Farmers Market and said agriculture is “undeniably central to our lives,” when addressing 100 attendees of the ‘State of Agriculture’ luncheon hosted by the Henderson-Vance Chamber of Commerce.

Horticulture and Field Crops agent Michael Ellington was on hand and at work as well, and it’s apparent months of preparation is starting to pay off.

The community garden a place where gardeners of all skill levels are welcome to learn and share their own knowledge about growing fruits and vegetables.

Garden beds are available to rent for the growing season – each 4 foot by 8 foot bed is $40 for the whole season.

Community gardens provide lots of benefits, Ellington said recently on his weekly Tuesday segment on WIZS. Fresh, healthy food is just the beginning.

Access to affordable, nutritious food can be limited, especially in underserved neighborhoods and communities, he said. Garden plots like the ones at the farmers market offer local hands-on solutions that can reduce food inequality and increase availability.

And it just makes sense that folks who grow their own fruits and vegetables are likely to eat more of each. Community gardens give people power over what they eat, he said.

Community gardens can bring diverse groups together, and soon, new friends are swapping recipes and stories while they pull weeds and keep their plots watered.

These places “reveal that social fabric that holds communities together,” Ellington said.

Macon added that cooperative extension programs support agriculture in all its forms – from livestock and horticulture to youth programs like 4-H.

The community garden is also a place where children can learn first-hand about where their food comes from – literally – not from a video screen or a textbook.

“They learn by planting seeds, watching them sprout and harvesting what they’ve nurtured,” Ellington said.

Planting a garden can reduce grocery bills and can reduce the amount of food waste that ends up in the landfill.

Community gardens also send a clear message to prospective businesses that residents care about where they live.

If you’d like more information about the community garden, visit the cooperative extension website at https://vance.ces.ncsu.edu, call 252.438.8188 or email Ellington at maellington@ncsu.edu.

There are many ways to help, from volunteering to sponsoring to making a direct donation.

And if you don’t have a green thumb, don’t fret. Just spread the word about the community garden to friends and neighbors.

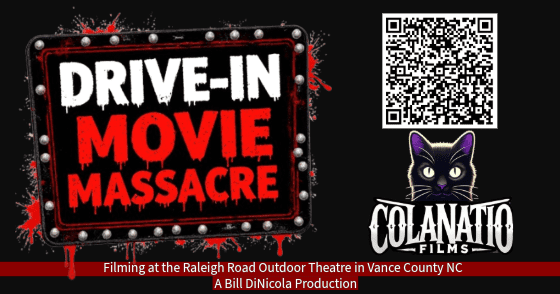

Wanna be in a movie? Wanna have a part in making a movie? Folks in the Henderson area will have their chance soon, because Bill DiNicola is looking for locals to be a part of Drive-In Movie Massacre, a comedy/horror slasher film that is going to be shot on location at Raleigh Road Outdoor Theatre.

And one thing he says for sure: the world premiere of the movie will be held right here in Henderson, at the iconic drive-in.

DiNicola, who got his start right here at WIZS, has moved to television and movie production, and he can’t wait to start filming. He said filming should begin in August or September of this year, and the final product is scheduled to be ready by September 2026. He’s formed a film company, ColaNatio Films, and he hopes this is just the beginning of having movies filmed in Vance County

He’s always been a big fan of horror movies, and his work in pre-production is what helped him get to this point in his career – creating a feature-length film.

Well, not Tom Cruise-Mission Impossible length feature film, but he said on Monday’s TownTalk that, with credits, the movie will be close to 90 minutes.

DiNicola said you need three things to make a movie – “a camera, a place to shoot and a story that people might be interested in.”

Camera, check. A place to shoot – the iconic drive-in in Henderson, check. And the story that people will be interested in. Check.

The script is about 54 pages in so far, and needs to be 80 pages or so. But it’s at the point where DiNicola is seeking funding for the project.

And a little star power.

He said he’s got local newsman-turned celebrity Mark Roberts on board for the project, as well as a “soft commitment” from Darcy the Mail Girl, who’s known in the horror/comedy genre.

The movie is a movie within a movie, DiNicola said – “It’s a slasher movie about people going to the movies to watch a movie about people going to the movie and getting massacred.”

And in the case of this movie, people are coming to the Raleigh Road Outdoor Theatre to see the movie.

“When you have an asset like that and you find out that people are interested in it and want to make it happen,” it’s a natural fit.

DiNicola said he sees Vance County as a great place to make movies, from the drive-in to Kerr Lake and more.

“What I really want to do,” he said, “is make movies in Vance County,” where he spent so much time as a child. “The woods, Kerr Lake…everything (is) kind of rolled into one In Vance County. The only thing you don’t have is film crews working in Vance County.”

He wants to change that.

Contact DiNicola at colanatio@gmail.com, 252.432.2235 or find him on Facebook.

Click Play!