Granville County Emergency Communications Honored by North Carolina 911 Board

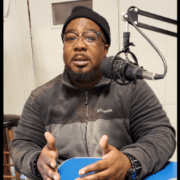

In his role as North Central Regional Coordinator for the N. C. 911 board, Brian Short sees how counties cooperate to provide the very best coverage possible when it comes to handling emergencies.

No longer a boots-on-the-ground participant, Short nonetheless witnessed first-hand how counties not affected by Hurricane Helene came to the aid of those in western North Carolina who were hit by floods and mudslides as the remnants of the storms ripped through the state.

The Granville County 911 call center was recently recognized by the state’s 911 board for the mutual aid it provided to Mitchell County from late September to mid-October.

Short may be a familiar name to many in the area – he spent more than three decades in service to Vance County, about 27 of which were as emergency services director.

His retirement in May 2023 was short-lived, however, when he became one of four state coordinators. The North Central region includes 22 counties, including the four counties in the WIZS listening area.

“I happened to be on duty at the state operations emergency center at the height of Helene,” Short said on Tuesday’s TownTalk. As mountain counties reported losing connectivity, Short said he and others manning the phones and radios had to figure out what to do.

“As they started to drop, we knew we had to act quickly,” he said. “I had already been working on a list of potential places to reroute those calls,” and when Granville County was contacted, he said 911 Emergency Services Director Stacy Hicks didn’t hesitate. “Yes, send them our way – we’re ready,” Short recalled her saying. “And just like that, Granville started getting those calls.”

That was on Sept. 27. For the next 17 days, about a quarter of all calls fielded by Granville County 911 were calls originating from Mitchell County, Hicks stated in a press release from Granville County Public Information Officer Terry Hobgood.

“Our team handled a wide range of emergencies, including flood rescues, medical calls, welfare checks, and reports of individuals trapped in homes or vehicles due to mudslides, downed trees, and rising waters. I’m proud of the work we did to assist Mitchell County while they were in distress while also continuing to provide the same emergency services to Granville County residents,” Hicks said.

“Granville County served as a Public Safety Answering Point ‘friend’ to Mitchell County and provided tremendous assistance and dedication to the citizens of western North Carolina by answering 911 calls from miles away in response to Hurricane Helene,” Short said.

Thanks to technology, overall consistency of operations and training that county PSAP employees receive, counties can come to the aid of other counties in emergency situations.

The way Short explained it, because of the mutual aid that unaffected counties were able to give to those ravaged by Helene in the western part of the state, “we lost no

911 calls, even during the heart of the hurricane Helene impact.”

Given the widespread devastation and loss of power, internet and cell phone service, the counties providing mutual aid had to think outside the box to get information relayed quickly and accurately.

“A lot of times, these PSAPs had to think on their feet,” Short said. “It wasn’t as simple as (sending) an email,” he said. “What it really came down to at the PSAP level was knowledge, creativity at the ground level” that played a critical role in sending help where it was needed.

“Every call they took was a true emergency,” he said – life and death emergencies. “I’m very proud of every PSAP in my region, they stepped up and did what they had to do.”