WIZS Radio Henderson Local News 01-21-26 Noon

Listen On Air at 8am, 12pm, 5pm M-F

WIZS Radio ~ 100.1FM/1450AM

Click Play!

Listen On Air at 8am, 12pm, 5pm M-F

WIZS Radio ~ 100.1FM/1450AM

Click Play!

Not only does Perry Memorial Library’s Youth Services Librarian Melody Peters keep track of all the programs that go on inside the library, she’s got to keep an eye on the weather, too.

And because weekend weather forecasts point to “winter weather,” Peters said she’s decided to reschedule the Teddy Bear Sleepover.

But don’t fret – the loveys and favorite stuffed animals will be invited in February to have their sleepover fun among the books, Peters said on Tuesday’s segment of The Local Skinny!

Just add that to the growing list of programs and events happening at the library as the calendar turns from January to February.

“We’re getting ready to get rolling,” Peters said. “Things will really get busy and I love it – there’s a lot to celebrate!”

All that wintry weather predicted for the weekend likely will be a distant memory by the time Tuesday, Jan. 27 rolls around. That’s when ‘Teen Time’ launches. Young people in grades 6-12 are invited to the weekly gathering from 6 p.m. to 7 p.m. in the Maker Space to take part in different activities.

“This is a program that will happen every Tuesday through the end of April,” Peters said.

The program kicks off with make your own pizzas and a t-shirt bag, she said. And while there probably won’t be pizza every week, plan on having some sort of snack while enjoying the activities, Peters added. Participants are asked to bring a t-shirt from home, but there will be extras on hand at the library, just in case.

“Each week will be something different,” she said, giving kids a chance to come to the library to hang out and do crafts together.

The first ‘Community Read-In’ of 2026 will take place at 4:30 p.m. on Wednesday, Jan. 28 and the library welcomes back members of the Henderson Fire Department who will create the ever-popular s’mores treats for participants. Explore the fire truck, read a book with a firefighter and then enjoy a deliciously gooey treat, compliments of the fire department and sponsor Fred’s Towing and Recovery.

The library hosts the Anime Club on the last Thursday of each month, beginning at 3:30 p.m. It’s a time when kids in middle and high school can gather to watch an anime and then do a craft activity. Book your spot by calling the library or emailing Peters at mpeters@perrylibrary.com.

Kids of all ages can take part in a Wizard of Oz scavenger hunt at the library as a lead-in to performances on Saturday, Jan. 31 of “Wizard of Oz on Ice” at McGregor Hall.

“It’s just a little something fun, something different,” Peters explained. “We’re happy to highlight and support McGregor Hall. We’re very lucky to have them in our community – they do amazing things.” Get tickets at https://www.mcgregorhall.org/. Visit or call the box office, 201 Breckenridge St., at 252.598.0662.

Find all the details about the scavenger hunt at the Youth Services desk in the library. Visit https://www.perrylibrary.org/ to learn about all the programs and services offered.

CLICK PLAY!

UPDATE: TUESDAY, JAN. 20, 2026

A subcommittee of Vance County’s America 250 group is in the process of collecting photos and information for the 124 individuals who hailed from Vance County and were killed in action in service to their country.

The plan is to have banners placed throughout the downtown area by Memorial Day this year. So far, everything is going along on schedule, but the committee is enlisting the help of the community as it continues to search for photos of the fallen heroes.

To date, 58 photos have been obtained, leaving 66 yet to be located. Each banner will feature the name and photo of the individual, as well as a QR code to learn more information about each person.

Barbara Harrison, who serves as chair of the county’s America 250 committee, also is heading up the subcommittee to find photos of those killed in action.

The America 250 committee is working with the Vance County Historical Society, Perry Memorial Library and others to get the word out about the banners and the photo search.

Below you can access the names of the men from Vance County who were killed in action since the county was established in 1881.

There are 10 names that remain under review to confirm that they were from Vance County, Tem Blackburn said, president of the Vance County Historical Society. Those names under review leaves a possibility that the final list could grow to as many as 134.

The banners will have a QR code on them, that, when scanned, a viewer will gain access to additional information about the individual. The library is the hosting website for the information that the QR code will access.

Blackburn expressed thanks to Patty McAnally and Monica Alston at Perry Memorial Library for their help with the project.

Visit https://www.perrylibrary.org/home and click on the tab ‘America’s 250’ to see the full list, or scroll down in this post.

He said that Tracy Madigan will coordinate with city employees to make sure the QR code on the installed banners can be accessed from street level.

“She going to investigate and do a test run,” Blackburn explained.

••••••••••••••••••••••••

UPDATE: MONDAY, JAN. 19, 2026; Submitted by Tem Blackburn, President, Vance County Historical Society

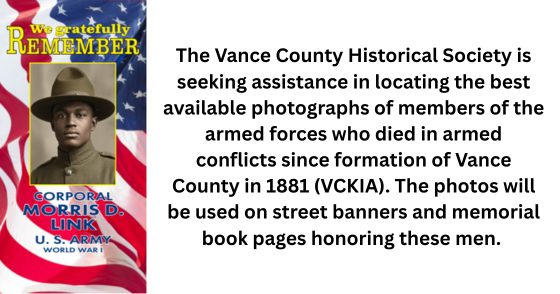

The Vance County Historical Society is seeking assistance in locating the best available photographs of members of the armed forces who died in armed conflicts since formation of Vance County in 1881 (VCKIA). The photos will be used on street banners and memorial book pages honoring these men.

The street banners will be deployed beginning on Memorial Day 2026 and each year thereafter on Memorial Day. The Memorial Book will be on permanent display at the entrance to the Society’s Historical Museum on the second floor of Perry Memorial Library. A QR code on each banner will link to the Memorial Book page for the VCKIA service member shown on the banner.

The street banners and memorial book initiatives are joint projects of Vance County Historical Society, the Vance County Committee for America’s 250th anniversary celebration and Perry Memorial Library. Both initiatives are being funded by the John William Pope Foundation.

A joint committee of VCHS, VCA250, and PML, chaired by Barbara Harrison, is conducting the photograph search. She also Chairs the Vance A250 Committee and is Regent of the John Penn Chapter of the Daughters of the American Revolution. In announcing the search, Mrs. Harrison said: “We are all excited about this project to honor the sacrifice of local service members since Vance County was formed in 1881. The memorial pages will present information that, in many cases, has not been known about their service and sacrifice, even to family members. The death notices and obituaries frequently provided no more information than the statement that the fallen warrior died ‘in France’ or ‘at sea.’ We now have access to a great deal more information about the specific locations, battles and conditions in which these men gave the last full measure of devotion to our country. The memorial book will formally inscribe them in our county’s memory.”

Perry Memorial Library has created a website hosting an online gallery of photographs of VCKIA located to date and a list of names of the fallen service members for whom no photographs have been located to date. The public, and especially VCKIA family members, are requested to provide photographs of VCKIA for whom no photographs have been located to date. These photos should preferably show the service members in uniform. In addition, anyone with a photograph of one of the VCKIA that is in better condition than those shown in the online gallery on the PML website should also contact the photo search committee using the PML website contact information for the VCKIA Photo Project.

The website can be accessed at: https://www.perrylibrary.org/americas-250/america-250-banners.

The members of the armed forces from Vance County who died in armed conflicts since formation of Vance County in 1881 are listed below. Further details about them can be found on the Perry Memorial Library website.

Oscar Allen Abbott

Ronnie Darnell Adcox

Clarence William Allgood

Huston Hammet Averette

Bennie Ayscue

John David Baker

Robert Lee Baker

George Armitage Ball

William Balthrop Jr.

Rex Baskerville

Robert Vernon Bennett Jr.

Clarence Ray “Billy” Brame Jr

Claude Hubert Breedlove

Lunsford Bernard Brown II

George T. Buchan

Edward W. Bullock Jr.

Thomas J. Bullock

Ernest Vance Bunn Jr

Robert Morrison Byrd

Joseph Cannady

Lee Andrew Cannady

Edward Fenner Capps

Grady Isaiah Carriker Jr.

Luther Monroe Chance

Simon Peter Christmas

Walter Christmas Jr

Charles Beacom Church

William Clifton Clay III

Hill Parham Cooper

Raymond B. Crabtree

George S. Debnam

Dalton James Dixon

Samuel Durham

Elon “Bud” Eastwood

George E. Edwards

Charles Duel Ellington

Warren Pershing Faucette

Ernest Kinnette Fleming

Floyd F. Fleming Jr.

Leon Floyd

Claiborne M. Fuller

Charlie T. Gardner

John Cleveland Greenway

Julian Thomas Greenway

Ellis Bailey Gregg

Edmond Gregory

Grover L. Griffin

Ernest W. Grissom

Thomas Jarvis Grissom Jr.

Sidney Alford Haithcock

Leo Edward Hamlin

Andrew Jackson Harris Jr.

James Clifton Harris

William Brown Harris

Walter Andrew Haskins

Harry Carlton Hedgepeth

Percy Lee Hedgepeth

Charles M. Hester

Carl Clinton Holbrook

Roger Edward Howard

Jessie Lee Huff

Emmett Fenner Hughes

Hugh Hunt

Charles Edward Ivey

Archie Jarrell

Norwood Thomas Jenkins

Clifton Cleo Jones

Fred O’Neal Jordan

Donald Arrington Joyner

Arthur Graham Kelly Jr.

Simon A. Kelly

Claiborne Field King

John Nathan King

Bill Brooks Knight

David Goode Langley

Eugene T. Lassiter

Henry Thomas Leonard

William Liles Jr

Morris Dabney Link

Robert E. Mabry

Henry Elmo Matthews

John H. Mimms

Russell Y. Mitchell

James Clifton Moore

James E. Moore

William Henry Moseley

Claude Edward Mustian

Luther Hammett Newton

Richard Turner Norvell

James Scott Norwood

Thomas Elmo Norwood

Edward Barney Parrish

Alvin W. Peace

Francis B. Peoples

Robert Lee Perry

John Lewis Poythress

Hamit N. Powell

Julius Donald Pritchett

Walter Pruitt

Jasper Davis Pulley

Charles N. Ranes Jr

Robert M. Rideout

Lawrence Jackson Rux Jr.

Graves Morgan Shotwell

James A. Steed

James D. Tarry

Chester Arthur Taylor

Phillip Earl Taylor

John Randolph Teague

William A. Teague II

William C. Vaughan

James Matthew Vernon

Jimmie Walker

Robert Dade Wall

Owen Ashley Wallace

Edwin Goode Watkins Jr.

James Tasker Weldon

Alpheus W. White

Freeman Whitfield Jr

Guy Wren

Wiley Lamon Wright

Click Play for TownTalk Audio!

The Extension Master Gardeners know a lot about plants and gardening, and they love to share that knowledge to others in a variety of ways.

You can find them at the Info Desk at the local farmers markets, providing answers to questions about sickly specimens and much more.

This year’s president of the Vance/Warren Extension Master Gardeners is Tammy Hight, who sat down with Vance County horticulture and field crops agent Michael Ellington to talk about plans for the year.

Hight said she learned about an upcoming Master Gardeners class just as she was entering retirement. It was perfect timing, she recalls. As an enthusiastic gardener, “I get to play in my yard – with a purpose – and stay connected to the community,” she said.

She, along with her fellow officers, are excited for the year ahead, all energized and ready to try new ideas and step “outside the box” as they make discovering together.

The group takes to heart its mission “to educate and empower the community through research-based gardening knowledge, sustainable horticultural practices and volunteer service that enriches lives and strengthens local environments.”

The personalized advice they provide to everyday folks is invaluable. You’ll find them at the cooperative extension office, at community events and gardening at the local farmers markets.

The Memorial Garden at the Vance County Regional Farmers Market allows gardeners of all levels to learn firsthand about native plantings and garden design.

The Well Garden in Warren County is another “living classroom” that allows gardeners a real-life experience.

Hight said the master gardeners enjoy meeting folks “exactly where they are” in their gardening journey, from the person who’s been digging in the dirt for decades to the person who’s just bought their first houseplant.

“My hope is that the community will see the Extension Master Gardeners as trusted, non-commercial advisors,” Hight said, “people helping people, who value advice from neighbors who aren’t trying to sell anything.”

They do promote, however, activities that expand the ideas of home gardening, seed-saving and sustainable practices to help families grow reliable, affordable food.

Find out more about Extension Master Gardeners at https://vance.ces.ncsu.

Listen live at 100.1 FM / 1450 AM / or on the live stream at WIZS.com at 11:50 a.m. Mon, Tues & Thurs.

Click Play!

In a meeting Monday afternoon, the Vance County Board of Elections set a hearing date of Jan. 22 at 10 a.m. to consider a challenge lodged by a Vance County commissioner concerning the residency of a candidate who has filed to run for a seat on the board of commissioners.

District 4 Commissioner Dan Brummitt has called into question the residence of Kelley Wade Perdue, who filed to run for the District 4 seat.

“I had some constituents call me with some concerns about where she lived,” Brummitt told WIZS News Monday. Brummitt said after some investigating, “it appears that she does not live at the address that she has listed…there was enough evidence to demonstrate that she doesn’t live in that house. She’s got to provide evidence otherwise,” he added.

Perdue told WIZS that she has been a registered voter in District 4 for years.

“During that time, I voted for Commissioner Dan Brummitt without any questions being raised about my residency. Now that he is being challenged for his seat, my residency has suddenly been questioned. I look forward to working with the Board of Elections. I’m excited to champion a new voice for District 4,” Perdue stated.

Vance County Board of Elections Director Haley Rawles told WIZS that the board of elections will hear from both sides – Brummitt, the “challenger,” and Perdue, the “challenged candidate,” as part of the official proceedings on Jan. 22. The hearing is open to the public and will take place in the commissioners’ meeting room on the second floor of the county office building, 122 Young Ave.

(This information was originally posted January 13th)

Join Freedom Bridge Resource Center for a Lunch & Learn session that will focus on overdose prevention.

The program, presented by Catherine T. Hazlitt, will take place at the Freedom Bridge Resource Center, 936 W. Andrews Ave. on Wednesday, Jan. 21 at 1:30 p.m.

The session is designed to increase awareness about overdose prevention, as well as providing life-saving strategies. It is open to anyone in the community who wants to learn more, including family members and service providers.

Registration is not required; just show up to attend the session.

Freedom Bridge Resource Center is a program of Community Partners of Hope.

(This information was originally posted on January 16th.)

The Vance County Board of Commissioners is likely going to consider a shorter time between real property revaluations than the current eight-year cycle.

It’s a move that county staff recommends, and following a discussion at the Jan. 9 annual retreat, it’s something that most commissioners would appear to get behind.

Vance County is one of about 30 counties across the state still using the eight-year cycle – which is the maximum time the state allows. Granville and Franklin counties, for example, currently are a on six-year cycle. By comparison, Wake County undergoes a revaluation every two years; about two-thirds of the state’s 100 counties use either a four-year or six-year cycle.

Many county residents experienced “sticker shock” when they opened their 2024 tax bills. More than 1,400 residents made appeals, according to County Tax Adminstrator Jennifer D. Williams.

Commissioner Dan Brummitt asked how many of those appeals resulted in adjustments to tax bills.” That would be good information to have,” Brummitt stated, expressing criticism about the results of the 2024 revaluation process.

The county contracts with an outside company to conduct the revaluations – it’s a long process that takes a couple of years to complete and costs hundreds of thousands of dollars. The 2024 revaluation cost was about $892,000 – one reason for the high price tag was because the reval included a full measurement of every single property in the county. That process doesn’t happen with every revaluation cycle, so future revals shouldn’t be as costly, Williams noted.

Another reason the price tag was so high is because the county doesn’t have the personnel in-house to do the work. With one appraiser on the county payroll, it simply isn’t something the county can do itself, and so it must contract with an outside company.

Williams said the N.C. Dept of Revenue and the UNC School of Government recommend having one appraiser on staff for every 10,000 parcels; Vance County has more than 20,000 parcels.

There’s a lot more to the revaluation process than many realize, and, despite efforts to communicate with county residents that the process was taking place, Williams said there was a great deal of “citizen frustration” and “sticker shock” once the bills hit mailboxes.

She said the county disseminated the information in a variety of ways, from putting notices in bills to speaking at events in the community.

“There was at least a two-year ramp-up leading up to a revaluation date,” Williams said, adding that the goal is to inform and educate – “we try to let them know what’s coming…(and) that the assessed value may not always mean an increase (in tax bills).”

Commissioner Leo Kelly said, “I don’t know what the answer is…you just do a little bit of everything” to try to communicate with residents in the most effective way.

Kelly said he would like to see future public information sessions held in the commissioners’ meeting room where county staff could address residents’ questions.

Williams said a six-year revaluation cycle would promote accuracy and improve taxpayer confidence.

Brummitt agreed that it may be time to start a conversation about a shorter revaluation cycle, but he would not be in favor of changing it right now.

“To knee jerk and move to a shorter cycle doesn’t make sense,” he said, adding that the county needs to be prepared for a shorter cycle, but he isn’t ready to introduce that change just yet.

“We’re seeing pretty consistent growth throughout the county,” he said, mentioning the nearby I-885 shortening the time it takes to get to RTP and the increased interest in properties around Kerr Lake thanks to the Microsoft data center near Boydton.

If the revaluation cycle shortens to six years it would be conducted in 2030 instead of 2032. But the county would need to get started in 2028 to get everything in order, Williams said.

CLICK PLAY!

Wayne Rowland, on the Vance County Cooperative Extension Report:

Managing forest edges can benefit wildlife and will improve the population of wildlife on your property.

Listen live at 100.1 FM / 1450 AM / or on the live stream at WIZS.com at 11:50 a.m. Mon, Tues & Thurs.

Click Play!

Lottery applications for Vance Charter School for the 2026-2027 academic year will be accepted beginning Jan. 26. Applications will be accepted through Feb. 27.

Applications can be accessed at www.vancecharter.org. The lottery will be held Mar. 7, according to information from John Sossamon, vice chair of the school’s board of directors.

Two parent information sessions will be held – one on Tuesday, Jan. 27 and a second on Thursday, Feb. 19. Each session will begin at 6 p.m. in the school’s media center.

Learn more at https://www.vancecharter.org/

Find details about the lottery process at https://www.vancecharter.org/page/vcs-lottery-info

Listen On Air at 8am, 12pm, 5pm M-F

WIZS Radio ~ 100.1FM/1450AM

Click Play!